I remember the frustration I felt as a new trader searching for knowledge and finding incomplete or flat out contradictory information. So I scrapped everything I had written and started over. I decided to write this article detailing just one trading strategy that works extremely well no matter the size of your account. It’s effective for both full and part-time traders and, the best thing is, it’s simple.

I said simple, not easy. The strategy I will lay out for you in the following pages requires discipline, focus, and that four letter word, WORK. There is no easy button when comes to trading. The truth is most trading strategies can be profitable if you master the biggest danger to your trading. That danger is YOU! That’s right, master yourself and most any trading strategy can be profitable.

Is there the possibility of losses? Yes! In fact, if you trade actively, losses will happen on a regular basis. However, if you follow the steps, I’m confident you will see improvement in your trading results. Winners will far outpace your losses, and your confidence will grow right along with your account.

I have traded full-time for more than 12 years and use this strategy every day. If you're willing to change and have the discipline to follow a simple set of rules, I believe it will produce consistent profits for you as well. So let’s get started!

Embrace Change

.jpg)

As a trading coach, I have had the pleasure of working with traders from all over the world. I can tell you that a key element of success is the willingness to change. Without question, all traders have the desire to make money but it is a rare few that have a willingness to embrace change. I understand that change can be uncomfortable and it usually means a lot more effort is required.

Are you really happy with the direction of your trading? If you’re reading this, my guess is the answer to that question is No. In fact, haven't you sufficiently proved to yourself what’s not working? If you keep doing what you’re doing, should you expect your results to miraculously improve? Not likely!

It’s time to question and evaluate everything. I’m going to introduce several ideas that you may want to dismiss out of hand as being too simple to actually work. When that thought comes to mind, I want you to re-ask the question: Are you happy with the direction of your trading?

Plan your trade and trade your plan.

When I began trading 27 years ago, I started with a very small account. If fact it was almost microscopic! I had read several books and taken several classes that started by telling me the importance of having a trading plan. Of course, I ignored that because how could that apply to me and my small trading account? Surely that only applied to those with more substantial accounts. Wrong!

Having a well thought out trading plan is essential for all trading accounts no matter the size. There is no shallow end or kiddy pool available in the market. If you are in the market, you are directly competing with the best and brightest. They have a plan and trust me they will not apologize or even think twice about taking your money.

Traders without a plan are subject to poor emotional decision making in the heat of the moment. Trading is a business and must be treated as such. Those with small trading accounts have very little room for error. If your plan is just to wing it, then prepare to be quickly parted from your money. I know that may sound harsh, but it is the truth. If you fail to plan, then plan to fail as a profitable trader.

Embrace Simple Charts

Price is king! New and struggling traders often make the mistake of overcrowding charts with indicators. They spend days, months and even years searching for the perfect combination of indicators that will provide consistent profits. Let me save you some time. It doesn't exist.

Many traders fall into the trap of believing that indicators give you the power to predict future price action. While indicators can provide useful clues, it’s wrong to think they have the power to predict all the possible outcomes. The market is full of fools attempting to predict future price action. Sure they can be right from time to time but even a broken watch tells the correct time twice a day.

I have built an entire trading career around following price action rather than trying to predict. I make trades come to me rather than me chasing after them. As a result, you will never see my talking head on CNBC but I will console myself by taking consistent profits to the bank.

Build a Qualified Watchlist

Making trades come you, requires building a watchlist of stocks that qualify. Working from a watchlist prevents chasing trades and allows the trader time to prepare. Another problem I often run into is traders chasing after the flavor of the day stock that is popping higher. When a stock is popping, traders will rush in, not considering the risk first, and immediately put themselves in a higher risk trade that may not be suitable. On the other hand, many traders will see the move and decide they have already missed it and stop watching the chart altogether. Both of these potential issues are easily fixed when working from a qualified list.

Building a qualified watchlist is much easier than you may think. First, we only want to look at stocks that fit with our account size. As an example let’s say you have a $20,000.00 trading account. Higher priced stocks would require too much of your account in a single trade. On the other hand, you may have rules to avoid very low-cost stocks or biotech companies due to their high volatility. To be efficient, screen out all stocks that don’t qualify.

Also we want to screen out all the stocks that don’t meet your volume requirements. Lastly, we only want to focus on stocks that are currently trending with the direction of the overall market. I do this using a 34EMA (exponential moving average) that has been trending at least 20 days.

From this simple screen, I build my watchlist and begin preparing for the next entry.

Preparing for the Trade

Now that we have a good list of trending stocks we have to begin preparing for the next entry. I do that by marking up the chart with support, resistance, and trendlines. I recommend using a chart cleared of all indicators and a white background with black and white candles. The human eye is much more receptive to black and white images. Seriously, if you look it up, you will find this to be true. Remember that question: Are you happy with the direction of your trading?

I call it a naked chart and you may be surprised that 99% of my trades are found using this simple chart without a single indicator.

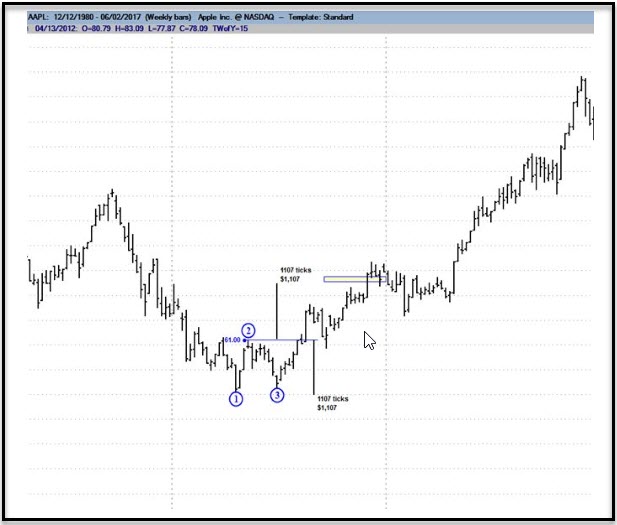

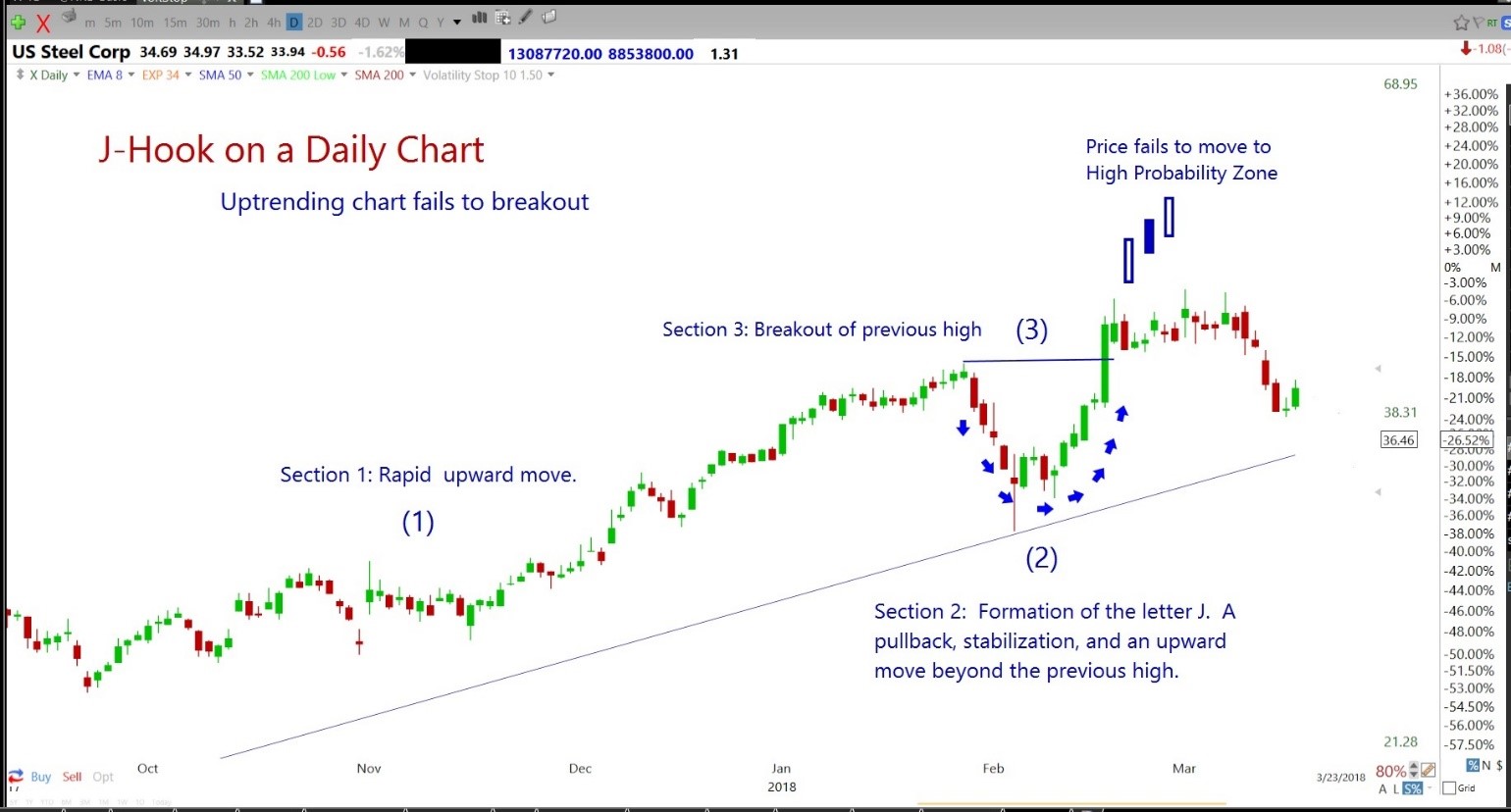

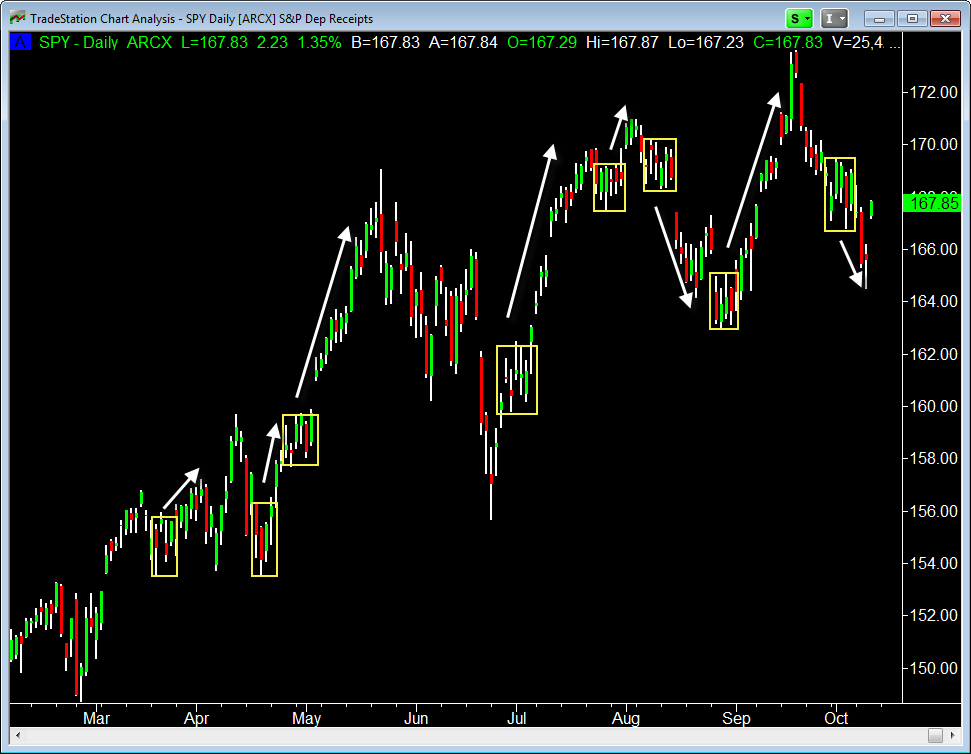

As you can see in the chart above, potential entries are easily identified. Because we are waiting for the trades to come to us, they can be planned for without rushing. The potential entries marked on the chart are near price support levels allowing for tight stop-loss orders and low-risk trades.

One Indicator for Easy Entries

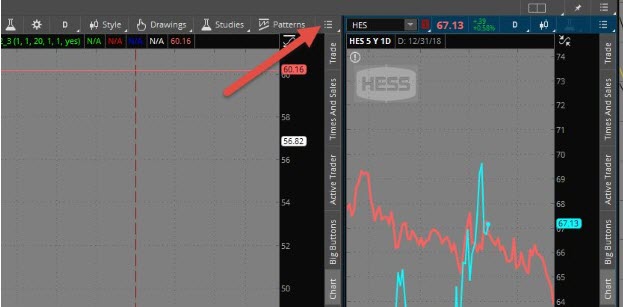

Could it be any easier? Yes, by adding just one indicator called Volatility Stop Indicator on my TC2000 Platform. It is an Average True Range indicator with these settings. True Range Period = 10, True Range Multiplier = 1.50. At the end of this book, I will provide links to setting up the indicator in TC2000 as well as on thinkorswim charts. Please feel free to reverse engineer it for any charting platform you use.

First, please understand there is nothing magic about this indicator. Price is still, and will always be, a top priority. I am an unapologetically conservative trader. I am also very selective about the charts and the trades that I take. In my opinion, Quality is far more important than Quantity especially if you want to improve your win/loss ratio and consistently profit.

The chart above is the same chart of Weight Watchers with the Volatility Stop Indicator turned on. The Red dots indicate price resistance and the Green dots mark price support. I recommend placing stop-loss orders just above the Red dots for a short trade and just below the Green dots for a long position. Notice the potential entries marked with the red circles are very close to where stop orders are located. This placement creates low-risk entries!

Simply follow when you see buyers reacting to price support. That means wait for the buy signal. No predicting, no guessing required! Once in the trade, manage the position by adjusting the stop at the end of the period you are trading (end of the day in this example).

Please note if you miss an entry, there is no need to chase it. As long as the stock remains in the trend, all you have to do is wait and prepare for the next low risk entry. Remember, we are looking for Quality over Quantity and don’t waste time with a stock that does not prove it’s worthy of your money.

You can now be in control, making the trades come to you! Follow the rules and this strategy is pretty hard to mess up.

Longer Term Traders

If you like longer term trades, take a look at the weekly chart below. Again, easy to spot low-risk entries that can be held confidently for months. Just follow the price up as long as the trend continues.

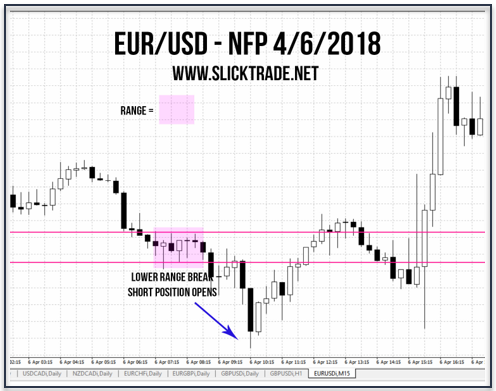

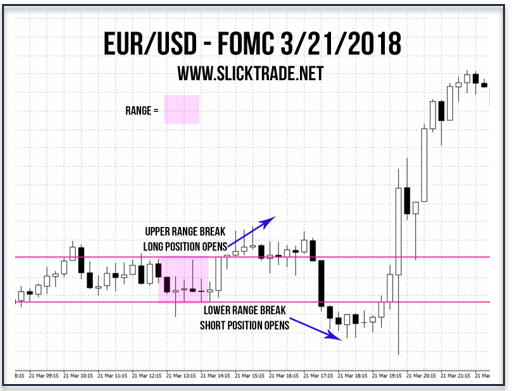

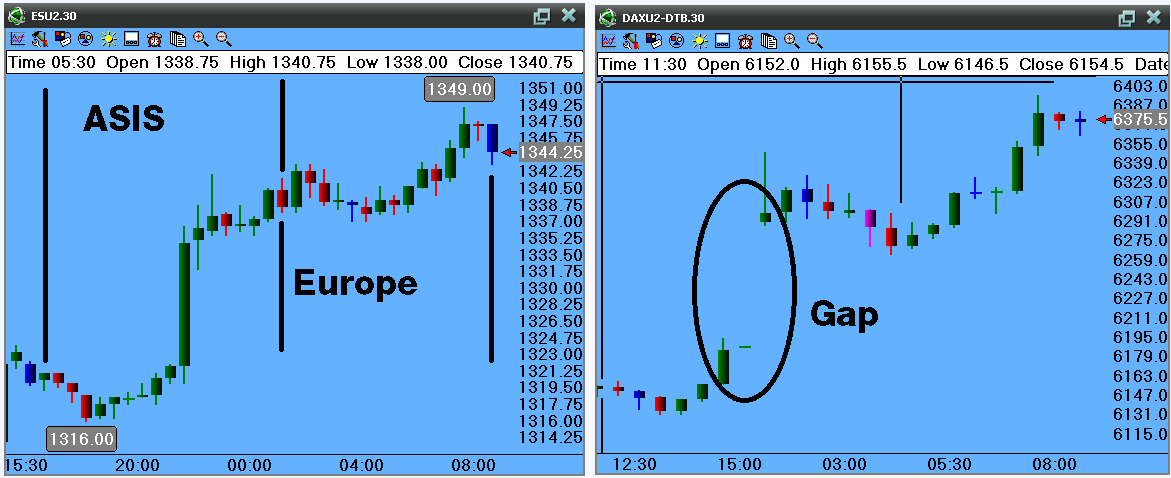

Day Traders

Yes, it works just as well for those of you that prefer intraday trading. The 5-minute chart below is trending up, so all you have to do is wait for a low-risk entry and manage the trade by moving the stop at the end of each period.

Following Price Action

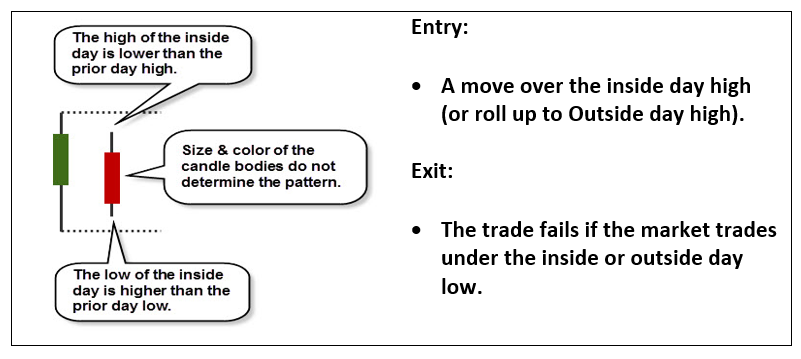

A question that I am commonly asked is, “What’s the buy signal”? What they are really saying is, “Just tell me what candle to buy.” I’m sorry to burst your bubble, but its never that easy. Put ten traders in a room with a chart to pick out buy signals, and you're likely to get ten different answers. What YOU see in the chart is the only opinion that should matter because that will be the basis of your trade plan.

Plan Your trade and then stick to Your plan!

As for me, I am looking for evidence of buyers reacting to price supports or trends. The signal might form a bullish engulfing, morning star or hammer candlestick pattern. Most important to me is where the signals are placed in the overall price pattern of the chart.

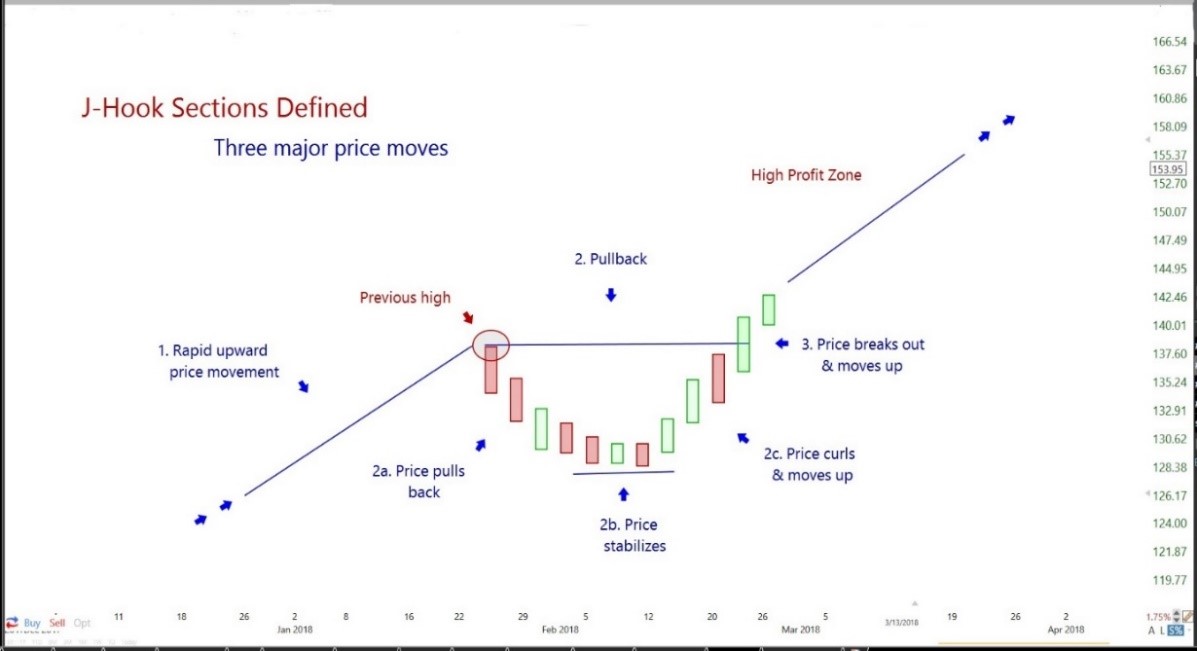

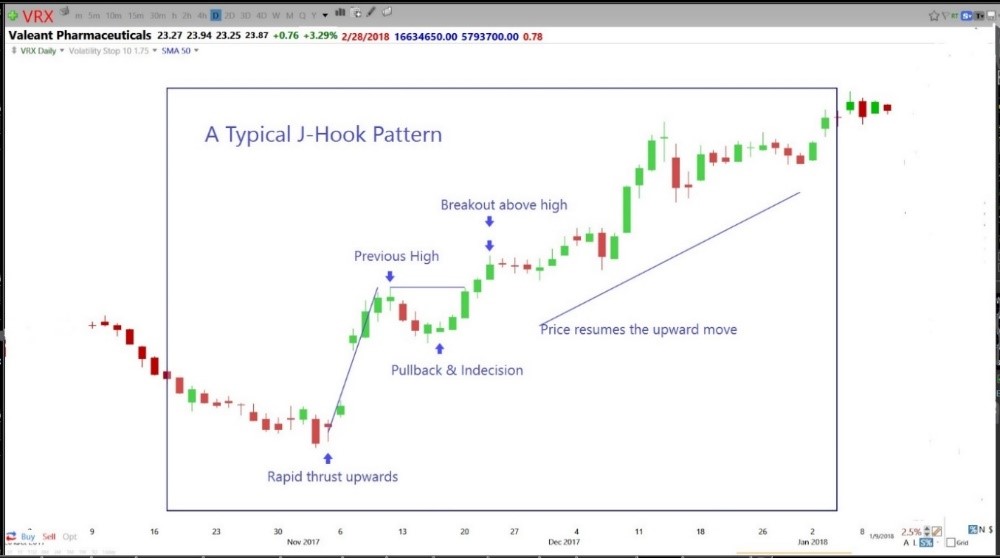

A pattern that I often trade with great success is what I call a Pop-Out-Of-The Box. It is a tight consolidation within a trend. See the chart below. If you are interested in learning more about the Pop-Out-Of-The-Pattern, I have a full workshop diving into the details of the pattern. Check it out on our website.

Pop-Out-Of-The-Box Pattern Information

Lessons Learned

Not only do we want to choose entry signals wisely, we also need to be mindful of the stocks we allow into our farm list. Look for stocks that have smooth, deliberate price action. Price is telling us a story and needs to be easily readable.

Price should respect support, resistance and trend. A stock chart filled with long wicks and tails tends to produce a lot of gaps and is a chart to avoid.

Trading is challenging enough without trying to trade something that is all over the place. Also banned from the watchlist are stocks with very low prices and those that lack sufficient volume. Remember, we are after consistency in profits and this is unlikely to occur if we trade stocks that show no consistency at all.

If you have been struggling as a trader or want to improve your win/loss ratio, I have a suggestion for you. Having confidence in your trading system is very important. To create that confidence, it’s essential to be very selective about the trades you take. Remember, Quality over Quantity!

To be selective, wait for the Volatility Stop to change from Red to Green. Once it is Green, evaluate the quality of the price action, trend, support and resistance that would be involved in the position. If the trade passes your rigorous evaluation, watch and wait for entry signals (buy signals) with stop-losses close at hand. In doing so, you have the benefit of seeing buyers reacting to support and you also have a low-risk trade if it fails. Always remember, there is no need to rush. Make the trade come to you!

Manage the Watchlist Daily

At least once every day flip through your watchlist watching for potential new entries. If a chart breaks the trend, remove it from the list and work to replace it with another trending stock. Farmers plant seeds and continually tend the crop removing weeds and fertilizing to maximize yields.Consider your watchlist as your farm and work diligently to tend your crop. Consistent profits are possible if, and only if, your crop is carefully managed. Fail to do this important job, and your potential gains will disappear as your crop dies.

Never Miss Another Trade

If you have the luxury of watching the market during the day, consider using Price Alerts. When I’m going through my watchlist, I am always on the lookout for trades that could be setting up. By placing Price Alerts on my charts, I am quickly notified when a stock price crosses a potential entry price. I have plenty of time to plan and evaluate the potential position long before the actual entry occurs.

Traders unable to watch the market can make use of conditional orders. I used conditional orders consistently when I was still working full-time. I would do all of my charting in the evening; placing orders and adjusting stops for the next day. As I was unable to check the market during the day, my next look at the charts would not be until the following evening. It’s not easy, but it is possible. Trust me, if I can build an account doing it, anyone can!

Avoid Temptation

Avoid the temptation to over-complicate. The old saying “If it ain’t broke, don’t fix it” applies well here. As traders, we are easily tempted by the next shiny thing that catches our eye. It starts off innocently, trying small tweaks but, before we realize it, we have fundamentally destroyed a perfectly good system.

Simplicity is a good thing! Simplicity works, as long as we don’t allow our big brains to get in the way. Even after all these years, I have to guard myself against changing up what has worked so well for me. Resist temptation and keep it simple!

Basic Rules

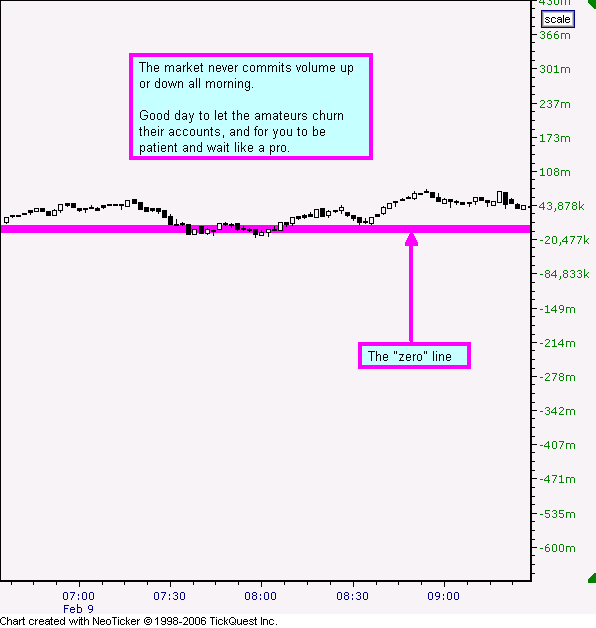

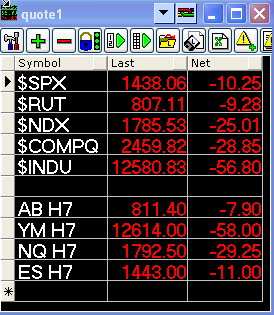

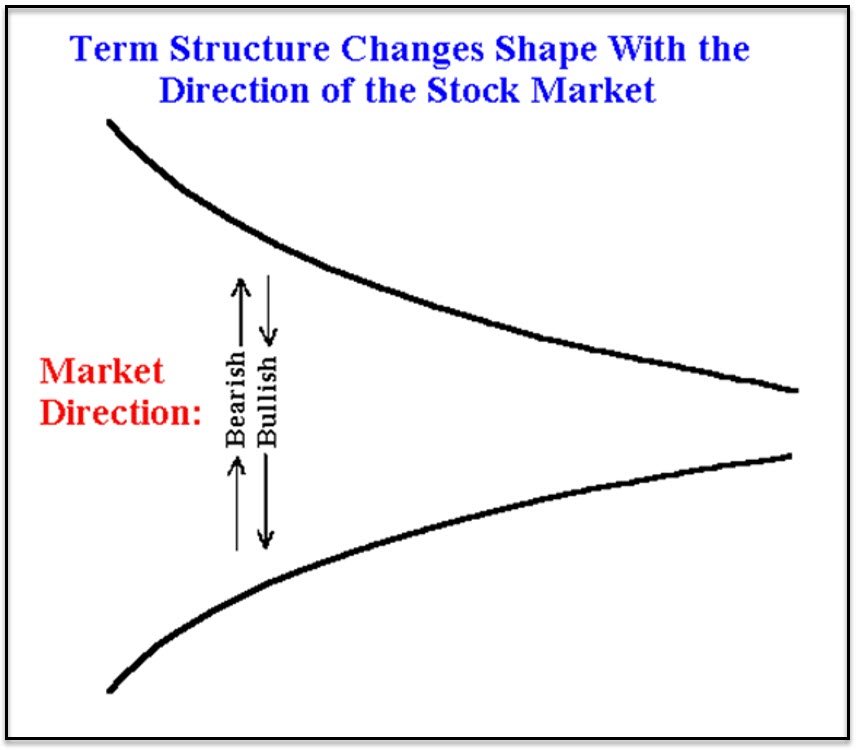

1. Always trade with the Direction of the Overall Market.

2. Only trade stocks moving with the Overall Market Direction.

3. Buy stocks that are AT or NEAR price support…with a buy signal.

4. Sell stocks that are AT or NEAR price resistance.

5. Never enter a trade without an exit plan.

6. Always know the exact amount of money at risk…acknowledge and accept this risk.

7. Make sure the potential Reward is greater than the Risk.

Do not trade if a single one of these rules is broken!

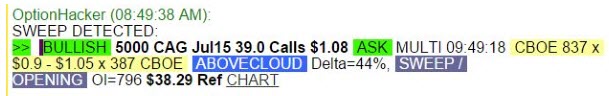

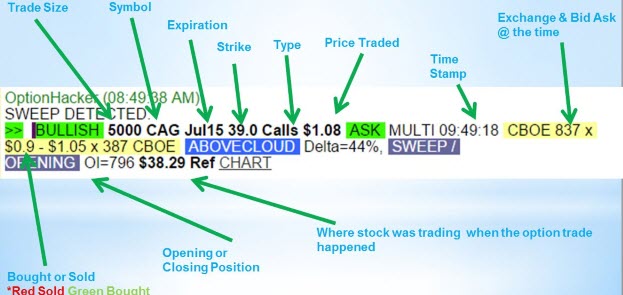

Option Traders

Because this strategy capitalizes on directional movement, it easily lends itself to the options trader. Obviously simple Call and Put contracts are useful but other directional option strategies can be used.

Debit Spreads, Credit Spreads and Calendar Spreads are all viable choices, depending on your risk tolerance. Iron Condor traders should consider legging into the position to increase the odds of winning on both sides of the spread. Longer term option traders will find LEAPs to be very profitable, as well as a Fig Leaf position.

I like to use conditional stop orders based on the price of the underlying stock. The Volatility Stop Indicator helps me enter option trades with low-risk and provides an easy method of managing the position mechanically.

Free Bonus Pack

Get the TC2000 34EMA Trending Easy Scan Code PDF, Building a Qualified Stock Scan for TC2000 PDF, Think Or Swim Volatility Stop Indicator Setup and Code PDF. Download Bonus Pack

THE SPECIAL OFFER

Build your trading foundation, get daily updates to help you size up the best opportunities, and never miss a trade again with our email trade alerts. Join us today and get a 30-Day Trial Offer for both Hit and Run Candlesticks and Right Way Options live trading rooms, daily videos, and trade alerts!

ABOUT THE AUTHOR

Author: Doug Campbell, Founder

Company: Right Way Options

Website: RightWayOptions.com

Alternate Website: HitAndRunCandlesticks.com

Services Offered: Trading Room, Email Alerts, Training Videos, Webinars

Markets Covered: Stocks, Options, Day Trading, Swing Trading

Doug Campbell has been trading for more than 25 years and has been a full-time educator and trading coach for over ten years.

.png)

.jpg)

.jpg)

.jpg)