Introduction:

Some of the most popular social media posts are the so-called “Life Hacks”. These fun little strategies take the worry out of doing everyday chores and generally make life easier.

Just like you can use life hacks to make life easier, you can use strategies to make trading the Forex easier.

By sticking with these Forex Life Hacks, you increase your chances of Forex success:

Forex Life Hack 1: Memorize the Top Candlestick Formations

Every trader knows to watch the candlesticks, but how many know candlesticks enough to see their recurring patterns? Few traders realize that candlesticks do more than show what the market is doing in that time frame, they also come together to create formations that expert traders can spot and use for profits.

There are a wide variety of candlesticks, and a lot of them have some pretty unique names, but there are a few that are important to remember:

Some candlestick formations to take note of are the Bullish Tweezer Bottom, the Bullish Piercing Line, the Bearish Engulfing Candle and the Bearish Shooting Star. Each of these names gives an indication of the market direction and makes some connection between the candlestick and its wick.

Spotting these formations early allows you to get into the market right before a major move occurs, thus increasing your profit potential and allowing you to strike while the iron is hot.

Forex Life Hack 2: Stick to 2 or 3 Strategies...Max.

A phrase we like to use is “simplicity leads to pips”. When you come at the market with 20 different strategies, you end up stretching yourself too thin and you miss out on profits because you’re trying too hard. That’s why it’s important to limit the strategies you use to two or three at a max.

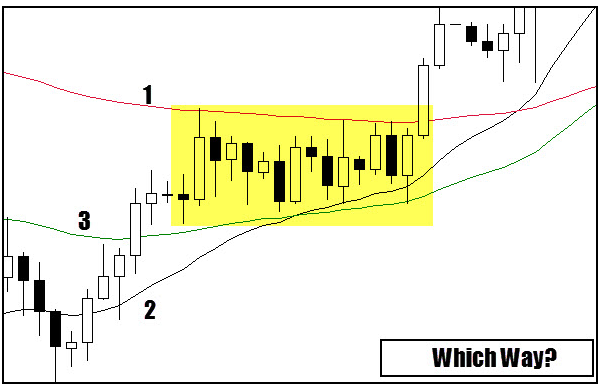

Why three? It’s not because it’s a handy number, or one that translates easily. It’s because there are three types of market movements, and it helps to have a strategy for each. You need a strategy for when you day trade, a strategy for when you are in a swing and/or a position trade, and one strategy for sideways movement.

Having three trusted strategies for each of these market conditions means that you should be more prepared to quickly review the market, whether the market is making for quick day trading movements, or is experiencing consolidation that spans ten or more days. You have something to analyze the conditions against, and the strategies to help you take advantage of these moves.

Forex Life Hack 3: Use Multiple Time Frames to Trade

The number one question new traders ask is what time frame they should trade within. The answer to this varies, but the bottom line is You should always be trading on more than one time frame!

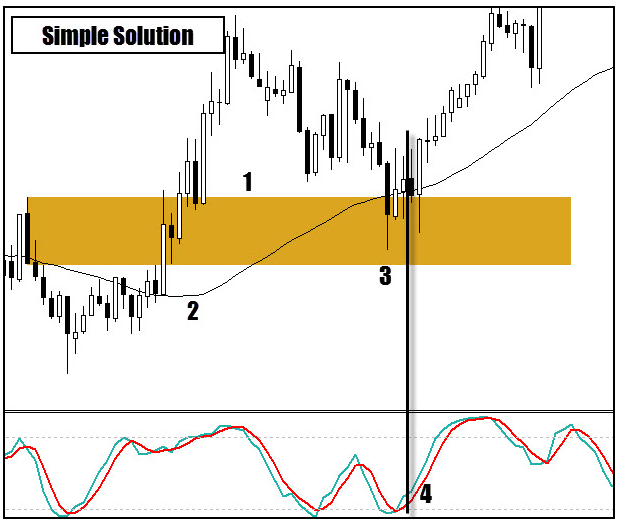

How can this work? It’s simple, time frames don’t work in a vacuum. Each one has an effect on the other, and patterns that appear in long-term trades make appearances in short-term trades...and vice versa.

For example, if you’re looking to enter on the one-hour chart, you want to begin your analysis on at least the 4-hour chart or any larger time frame’s chart.

The rule is to always have your secondary, larger time frame be at least four times the size of your initial time frame.

Think of timeframes of having a parent-child relationship to each other. The larger timeframes will have an effect on the smaller ones, much like parents have an effect on their children. The larger timeframe sets the scene for the smaller timeframes. Once you’ve established the overall direction of the market by the larger timeframes, you can trade the smaller timeframes for the specific entry and exit points.

A monthly time frame typically shows the next A-B-C-D formation for only the next 2,000 pips-worth of movement. The daily time frame shows the corresponding movements that create the larger A-B-C-D formation for the next 500 to 1,000 pips worth of market action.

The great thing about this method is that it solves the largest problem that faces many currency traders. That problem is knowing when to stop buying and when to start selling.

With the larger movement identified, traders can better determine when the market’s tides are preparing to change for a full movement in the other direction, as opposed to the natural wave-like movements that make up large market swings.

Forex Life Hack 3: Never Risk More than 2 - 5% of Your Account

A good piece of advice in life is to never risk more than you’re willing to lose. Whether you’re trading in the stock market or taking a mortgage out on your house, you should never put up more than you can live without. This is especially true when the thing you’re risking is money.

It’s worth mentioning again: You should NEVER risk more than you’re willing to lose.

The Ultimate Traders Package on Demand™ suggests never risking more than five percent of your account.

You have to understand, before going into the market, that every trade you might do comes with it some risk. There isn’t a trader in history that has a 100% winning percentage. The fact of the matter is that you will lose at some point, but when you manage your risk successfully you can take those losses and live to fight another day.

You also want to be able to put in enough money to make a profit. After over 20 years of experience, we have figured out that the sweet spot between making money, and not going bankrupt when losing money, falls in the two to five percent range.

We recommend beginner or more risk-averse traders to start with risking only two percent of your current trading pool in every trade. Once you become more experienced in the market, or your profits have risen enough, you can move to three, four, or the full five percent.

Forex Life Hack 4: Identifying and Trading the King’s Crown

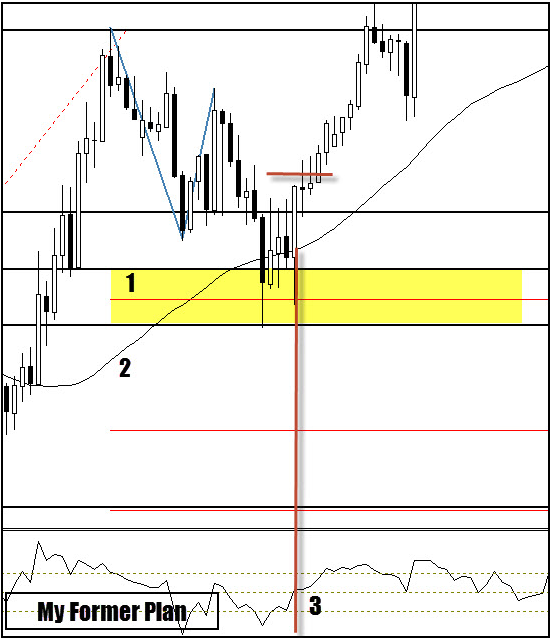

One of the more famous, and often used, strategies is something called the Head and Shoulders pattern. This happens when a bullish trending market makes a peak and begins to retract. The name comes from the picture the market makes as it peaks and valleys. The highest point is the head, and the two lows on either side of it are the shoulders. In theory, you draw a “neckline” connecting the two shoulders and begin to trade at that point.

The problem is, the market will often overcorrect itself and you’ve taken a loss before you knew what hit you. That’s why the FX Chief™ prefers to trade a different pattern: The King’s Crown.

The King’s Crown is trading beyond the “shoulders” of the Head and Shoulders pattern. Once the market takes out a low of support, it has a tendency to bounce back up and wave before the market finally falls. In this strategy, your stop would be taken out on that rally right before the market turned to complete your direction.

Basically, you aren’t trading the neckline, you are trading the breaking point beyond the lowest low. This extra spike in the market (turning the person in a crown) allows you to see the true indication of the markets and could lessen the chance you have of taking on losses in the future.

Forex Life Hack 5: Learn to Love the Stochastic RSI

Think of the ups and downs of the market as trends like in the fashion industry. Take leg warmers for instance.

Back in the 80s leg warmers were very popular, they were used by a large segment of the population, and then once it hit a certain point it became TOO popular and there was a backlash created against it, making the trend slowly go away.

A lot of fashion manufacturers would have loved to have known when the trend was starting to go away. They would have wished they knew some kind of indicator.

There might not be an indicator like that for the fashion industry, but there is for the markets. It’s called the stochastic RSI, and it could be your key to trading.

The stochastic RSI is made up of two lines that serve as a sort of benchmark for when the market is looking to reverse. If the stock is traded too high, it will break that line and begin to trend down. If the stock is going too low, it will break the bottom line and start trending back up.

Having a handle on the two barriers that the stochastic line makes up will give you a sense as to when you should reverse your direction and go from bull to bear, and vice versa.

Forex Life Hack 6: Utilize Stop-Losses for Your Wins

How familiar does this sound?

You put in to the market and, like a good trader, you set your stop. However, you find yourself constantly being taken out just before your big win. It’s a common problem that has one easy solution

You need to change your stop-losses as the market changes!

As the market fluctuates, the stop losses grow larger in size. This volatility creates higher highs and higher lows, which can spell higher profits for smart traders.

And smart traders adjust their stop losses to mirror the market.

Traders make stop losses to prevent themselves from losing their entire account over the course of one trade. By setting a minimum number for the market to hit, once the market hits that number, the trade is automatically ended and the loss is taken. The way to properly use a fluid stop-loss number is to move the minimum number in accordance with the market moves.

Let’s look at an example.

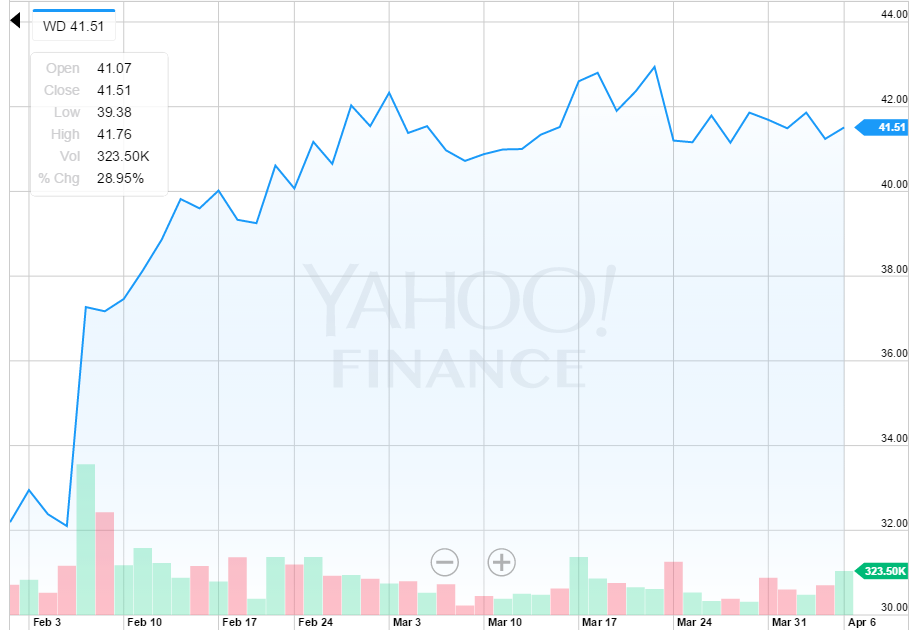

The chart below has several yellow circles. These circles represent the stop-loss price at different times in the trading timeframe. Starting from the furthest left circle, you would adjust your stop-loss to match the next lowest number the market hits (which is the new yellow circle).

Even without the benefit of seeing the actual numbers, you can see the difference between the furthest left and the furthest right circle. This pip difference would be lost if you didn’t utilize a moving stop-loss number.

How do you know when to move your stop-loss?

It’s easy. Look for a high or a low that has two candlesticks to the left, and two candlesticks to the right that are either higher or lower from that point. A high will have two lows to the left and right, a low will have two highs to the left and right.

Forex Life Hack 7: Using Reversals to Your Advantage

Trading occurs in a 24-hour window consisting of three different trading sessions: European, U.S. and Asian sessions. The European session has the most movement, followed by the U.S. and then the Asian markets. More often than not, the market will reverse directions when one session ends and the other begins. It’s by playing off this reversal that the most pips are captured.

It stands to reason that if the European session is trending bullish that once the American session kicks in, it will set up a reversal and the market will turn into a bear.

By utilizing this strategy you can pinpoint the reversal points, take advantage of the market movement, and identify when a market high and low will occur. With three trading sessions happening per day, there is the potential for 2 reversal points per day, which means that using only one strategy can dictate how you look at three different markets.

Forex Life Hack 8: Pinning Your Trading Personality

There are four distinct types of trading personalities. Finding yours could be the key to trading your strengths and limiting your weaknesses. It’s rare for a new trader to know their personality, so read the explanations and see if there is one (or multiple) that describes you.

The Now Trader: The now trader wants to get in, get their pips, and get out. They generally use smaller time-frames, spend less time per-day trading and capture smaller pip numbers. However, because they trade in such short timeframes, the Now Trader tends to trade more often and have more straightforward trading strategies.

The In-The-Game Trader: These traders love to check into the market daily, but prefer their action to be longer-lasting and tend to favor larger pip captures over a longer period of time. The daily trader often trades in the more mid-range timeframes and pays close attention to reversals and predictive fibs.

The Adrenaline Junkie Trader: These traders only trade once, or a couple times, per month based on major announcements such as quarterly or earnings reports. They love the riskiness of the market and tend to trade for only a couple hours at a time, but they end up winning big if their strategies hold true.

The Low-Maintenance Trader: The ultimate set-it-and-forget-it trader. They like to trade in the long-term by utilizing strategies that end up with big profits over many months. They aren’t looking for the thrill of the high-risk maneuver, or the commitment of a daily trading schedule. Rather, they are banking on safer picks that will benefit them in the future.

There is no right or wrong way of trading, there is potential to make money in all of them. What matters as a trader isn’t when, or how often, you trade. The key to successful trading is managing your risk, developing your strategy, and making smart decisions based on the charts.

Summary

Like any Forex tip, these can’t guarantee a win, and trading the Forex has an inherent risk involved. However, these tips can provide some insight into the mindset of those who have successfully traded in the past.

Using the tips seen here along with sound risk management, having a secondary source of income is possible by trading the Foreign Exchange.

THE SPECIAL OFFER

Available for a limited time, get the #1 trading tool that I use to detect trade setups and access to trading strategies geared towards improving your consistency 100% free by visiting us here!

ABOUT THE AUTHOR

Before his days as an expert analyst and trader seen in Trader Planet's Digital Journal, Your Trading Edge and FX Street, Josh was your average guy before him became the Forex world's FX Pathfinder. He knew he wanted to do something he was passionate about for a living, but it seemed like nothing was working out.

Josh has made a name for himself with the London Daybreak strategy and trading feats such as doubling his trading account in a single month and earning $10,000 in 30 minutes with his personal trading strategies. As a course creator, mentor and active instructor with MTI, you can find Josh in MTI student classes, live training sessions and MTI's free workshop series that are open to the public.